Hours x pay calculator

The average full-time salaried employee works 40 hours a week. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

The Headache Free Guide On How To Pay Taxes As A Freelance Creative Tax Help Calculator Helpful

Based on this the average salaried person works 2080 40 x 52 hours a year.

. There are two options in case you have two different. In order to calculate an hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week. See where that hard-earned money goes - Federal Income Tax Social Security.

To enter your time card times for a payroll related calculation use this. To determine your hourly wage divide. In other words it determines how much you will be paid for each of the time periods given how.

Enter the number of hours and the rate at which you will get paid. To decide your hourly salary divide your annual income with 2080. It should not be relied upon to calculate exact payroll or other financial data.

This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. You should refer to. Our Hourly Paycheck Calculator is designed to provide general guidance and estimates.

37 x 50 1850 hours. This calculator converts a given hourly wage to a daily weekly monthly and yearly salary. Next divide this number from the.

How do I calculate hourly rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculator Use Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

Based on a standard work week of 40 hours a full-time. Next take the total hours worked in a year. 20 per hour x 2080 hours worked per year 41600 per year To account for one week of unpaid time off or 40 hours of unpaid time off her adjusted salary can be calculated.

For example for 5 hours a month at time and a half enter 5 15. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year.

- regular hours worked in a month 160 - standard hourly pay rate 20 - overtime hours worked 30 - overtime pay rate 30 - double time hours 5 - double time pay rate 40 and a one. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

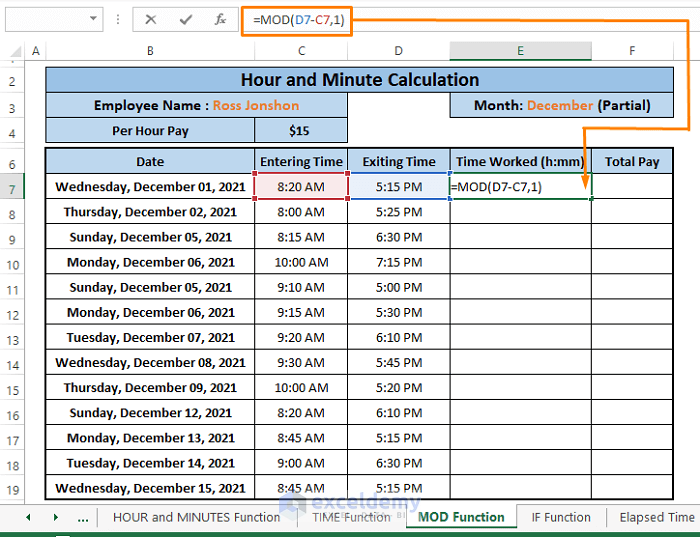

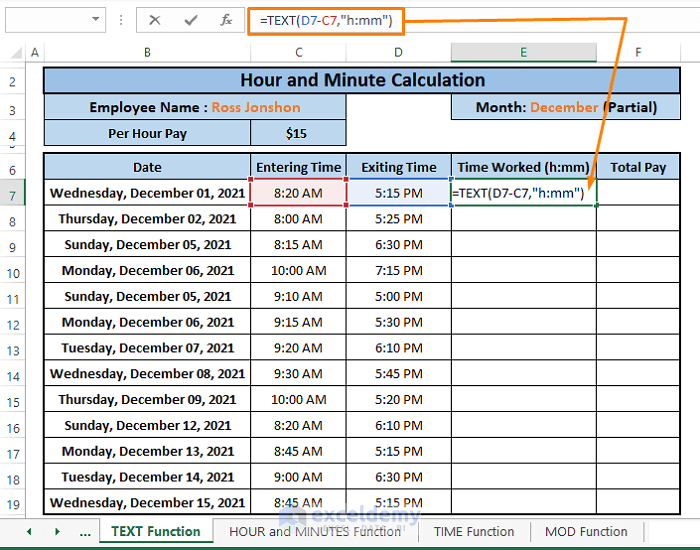

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Excel Formula Basic Overtime Calculation Formula

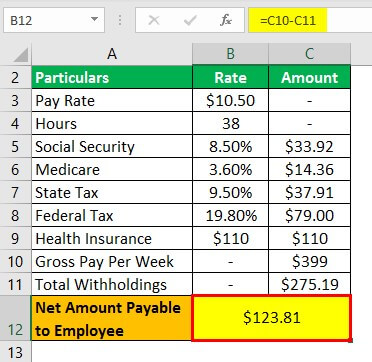

Payroll Formula Step By Step Calculation With Examples

Overtime Calculator

Teaching Resources Lesson Plans Teachers Pay Teachers

Hourly To Salary What Is My Annual Income

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Overtime Calculator To Calculate Time And A Half Rate And More

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Biweekly Time Sheet Invoice Template Word Timesheet Template Card Templates Free

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Hourly To Salary Calculator

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Budget Planner Budgeting Budget Planner Printable

Python Program To Calculate Gross Pay Python Programming Python Helpful

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions